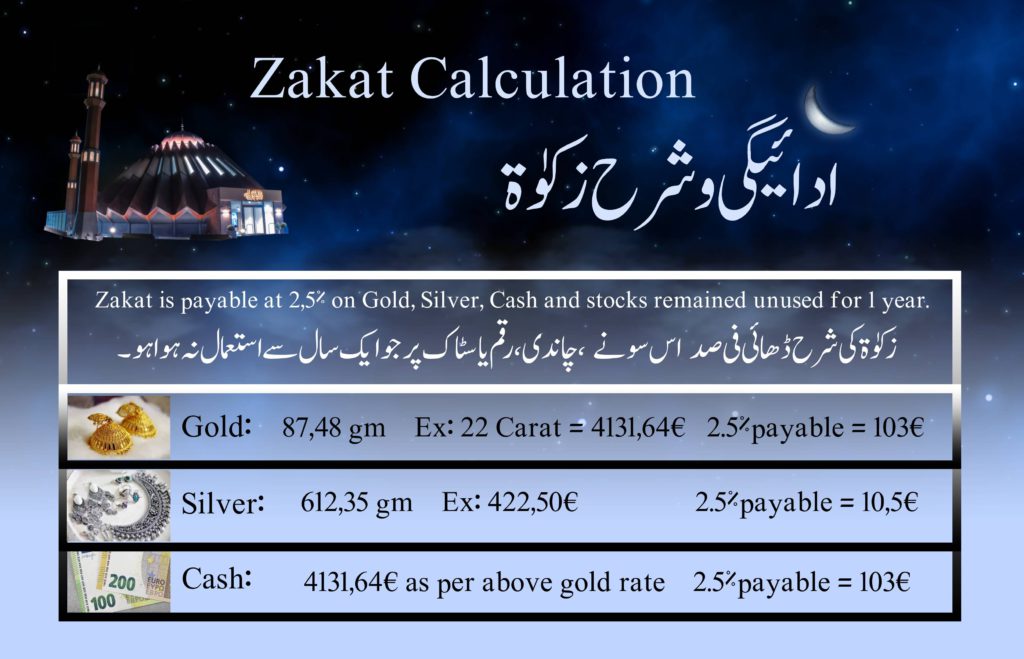

Zakat Calculation

Zakat is among the 5 pillars of Islam and compulsory to be paid by the people who meet its conditions. Following are some guidelines on zakat payment.

What is Zakat:

Charity towards man, in the widest sense of the word, is the cornerstone of the Islamic society and a constant theme in the Quranic teachings. There are two kinds of charities in Islam: the obligatory and the voluntary. The obligatory charity is called Zakat while the voluntary charity is called Sadaqah. Read More about zakat here>>

Who must pay Zakat:

Zakat must be paid by everyone who has assets (Gold, Silver, Money and/or Stocks) upto Nisab of zakat unused for 1 year.

Nisab of Zakat:

Nisab of zakat is one or more of the following:

1: Gold: 7.5 tola = 87.48 grams

2: Silver: 52.50 tola = 612.35 grams

3: Cash equivalent to 7.5 tola or 87.48 grams gold. which is ~4131,68 € today for 22K

(today’s rate for 22 Carat 47,23 € / gram)

How much zakat should be paid:

If above Nisab is met then one should pay 2.5% of the amount of gold, silver or cash.

When zakat should be paid:

Zakat is an Islamic sacrifice and the year for the purpose of calculation is the lunar year. It is recommended to calculate the duration from one Ramazan to the next and is good to pay Zakat during Ramazan.

Examples calculations:

Zaid has 4200€ in his account. Over the next year he has added and withdrawn money from the account, but during the year his account’s minimum balance was more than 4131€ (current amount of 7.5 tola gold).